China’s health and wellness industry, currently valued at US$683 billion, has seen particularly marked change as consumers reconsider what it means to be well and take care of their health in the age of a pandemic.

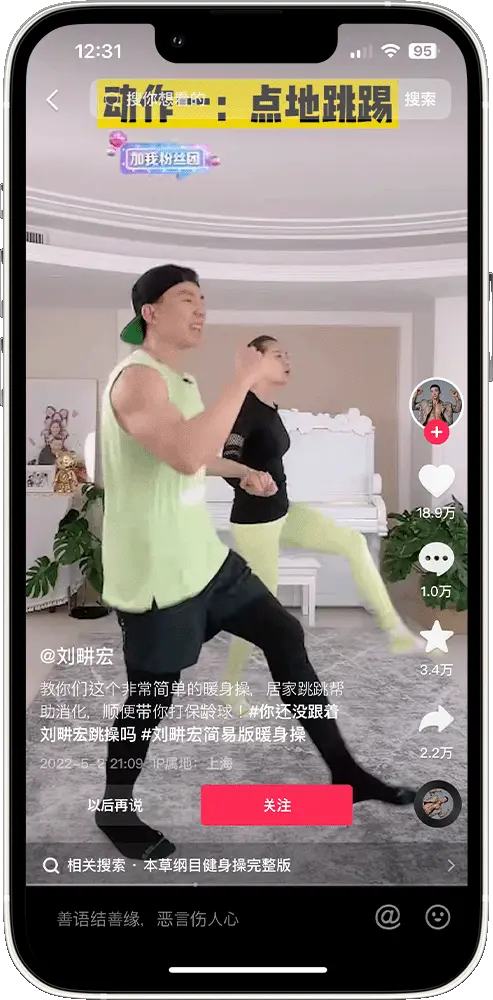

From fitness livestreamers to the rise of niche sports, China’s fitness trends reflect a shift in value. Younger consumers are increasingly embracing active lifestyle activities and aspirational brand consumption as an essential outlet for stress relief. For brands, making an authentic connection with these emerging communities is the key to growth and success in the world’s biggest consumer market.

Local brands have expanded probiotics to gummies, jellies, cookies, and beverages. These products have a broader appeal than the traditional formats of pills and yoghurts and can be taken by kids and adults alike. Many young Chinese consumers are taking them not just for the benefits of probiotics, but also for the flavour and texture. As a result, some local probiotic brands are responding by carefully marketing their supplement products as a healthy and tasty alternative to typical snack food products.

However, as with most products that target the health and wellness or personal care space (especially ingestible and topical products), international brands have a cache and a quality associated with them that local domestic products do not, thanks to the perception of purer ingredients, rigorous testing standards, and more.

Much of this focus on wellness is rooted in a culture of traditional Chinese medicine (TCM) which belief in and use of are prevalent among older adults in China. Prescribed TCM herbal formulas are referred to as “supplements for restoring an unbalanced body”. However, with the targeted benefits of supplements that are readily available in West, many older Chinese adults are also turning to nutraceuticals to keep their bodies fit and healthy, to continue leading an active life after transitioning to old age.