Digital Marketing in China: Top Channels + Tactics in 2022

There isn’t a brand on the planet that doesn’t want to launch in the world’s largest e-commerce market. With a population of 1.4 billion people and crazily high internet penetration, the opportunity for brands in China is HUGE.

Unlocking that potential, however, isn’t a straightforward process. Chinese consumers are incredibly savvy — and the market is fiercely competitive.

Success in China ultimately takes good marketing. Fail to cut through the competition and make enough noise, and your brand and product will be nothing more than a drop in the ocean.

Any brand serious about a China market entry has to invest in digital marketing. And the question everyone wants the answer to is: where do you focus that marketing spend?

Before you even begin to think about digital marketing in China, you first need to understand the country’s e-commerce market.

The bulk of online transactions in China take place via e-commerce platforms (hint, hint). Tmall leads the market with about 50% of China’s annual e-commerce spend. JD.com is second, with around 26%.

Chinese consumers frequent these apps multiple times a day, but there are tons of other apps that are also keeping consumers’ phones in their hands.

That’s why we’ve put together this quick and simple guide to digital marketing in China. To help you understand the channels and tactics that brands must leverage to grow market share heading into 2022 and beyond.

Chinese e-commerce platforms 🛍️

Tmall and JD.com are China’s leading e-commerce platforms. These are the places where Chinese consumers go to shop – and where more than 80% of online transactions occur.

- 881 million monthly active users

- Holds roughly 50% of China’s e-commerce market

Offers cross-border e-commerce via Tmall Global

- Owned by Alibaba Group

387 million monthly active users

Holds roughly 26% of China’s e-commerce market

- Offers cross-border e-commerce via JD Worldwide

- Part-owned by Tencent

If you’re a consumer brand, then you will typically be setting up your online shop(s) on either or both of these platforms. But these platforms are more than just a point of sale. For most brands, they replace the need for a website.

Unlike with Amazon and other e-commerce marketplaces in the West, brands get much greater control over the customer experience on these platforms — and the experience for users is more akin to a virtual shopping mall.

Consumers enjoy interactive content like blogging, video and livestreaming, and the platforms serve content to users based on their behaviour in the app. That provides hyper-personalized experiences and keeps consumers coming back for more content multiple times a day.

Vitamix’s JD store

Tmall and JD get significant traffic. Naturally, inside these marketplaces – i.e., the bottom of the marketing funnel – is where you’re going to see the greatest ROI on your spend. That’s why brands often allocate most of their marketing budget to these platforms in year one of their market entry – as they look to initiate some momentum with sales.

Brand campaigns see the highest ROAS, but you’ll want to run campaigns for both brand and product (more on brand vs product campaigns below).

In-platform advertising on e-commerce platforms is where you’ll get the greatest ROI, but there is also a finite amount of what you can eat up.

Campaigns will eventually reach peak performance before returns start diminishing, so you need to know when to cut off any additional spending. After that, you’ll need to look outside the platforms.

Brand vs product campaigns

Chinese consumers search for products differently. A lot of categories in China are branded — i.e. consumers are searching for brand names rather than by category or product names. That’s particularly true for many FMCG categories on Tmall and JD, and why brands often need to pursue an omni-channel approach to really drive awareness and sales.

Before you activate any digital marketing in China, make sure you understand how consumers behave in your category.

Search in China 🔎

Baidu is China’s leading search engine – controlling around 80% of China’s online search market. When it comes to searches with purchase intent, however, Chinese consumers typically aren’t making those on Baidu. They head to Tmall or JD.com instead.

That said, those at an early stage of their buying journey are more likely to search for more information and reviews, before making a decision. That’s particularly true when it comes to buying complex products or services – like B2B buying, for instance.

Baidu can point to some e-commerce platforms, but it’s most often used for driving traffic back to a .CN website.

Baidu can also be indexed to deduce large amounts of information about the Chinese market. That includes:

- Which keywords are most popular within your SKU segments

- What sales volume your brand can expect over a given time period

- Where your brand lines up against competitors

- Customer demographic insights

- Seasonal trends

- And more

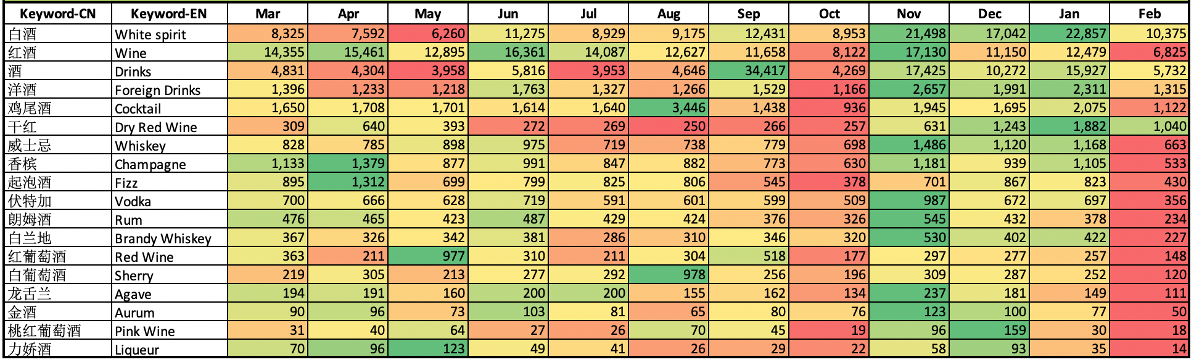

Keyword data provided by WPIC’s custom-built big data tool: Discripto

Keyword data provided by WPIC’s custom-built big data tool: Discripto

Data is key to digital marketing in China. WPIC’s custom-built big data solution provides your business with end-to-end visibility into China’s online market. Learn about Discripto.

Social media in China📱

Chinese consumers cannot keep their phones out of their hands. Social media is central to people’s daily lives, and where the country’s 900 million internet users spend most of their time online.

Chinese social media is dynamic and diverse. Consumers frequent a multitude of apps, multiple times a day. It’s a far more complex landscape than it is in the West.

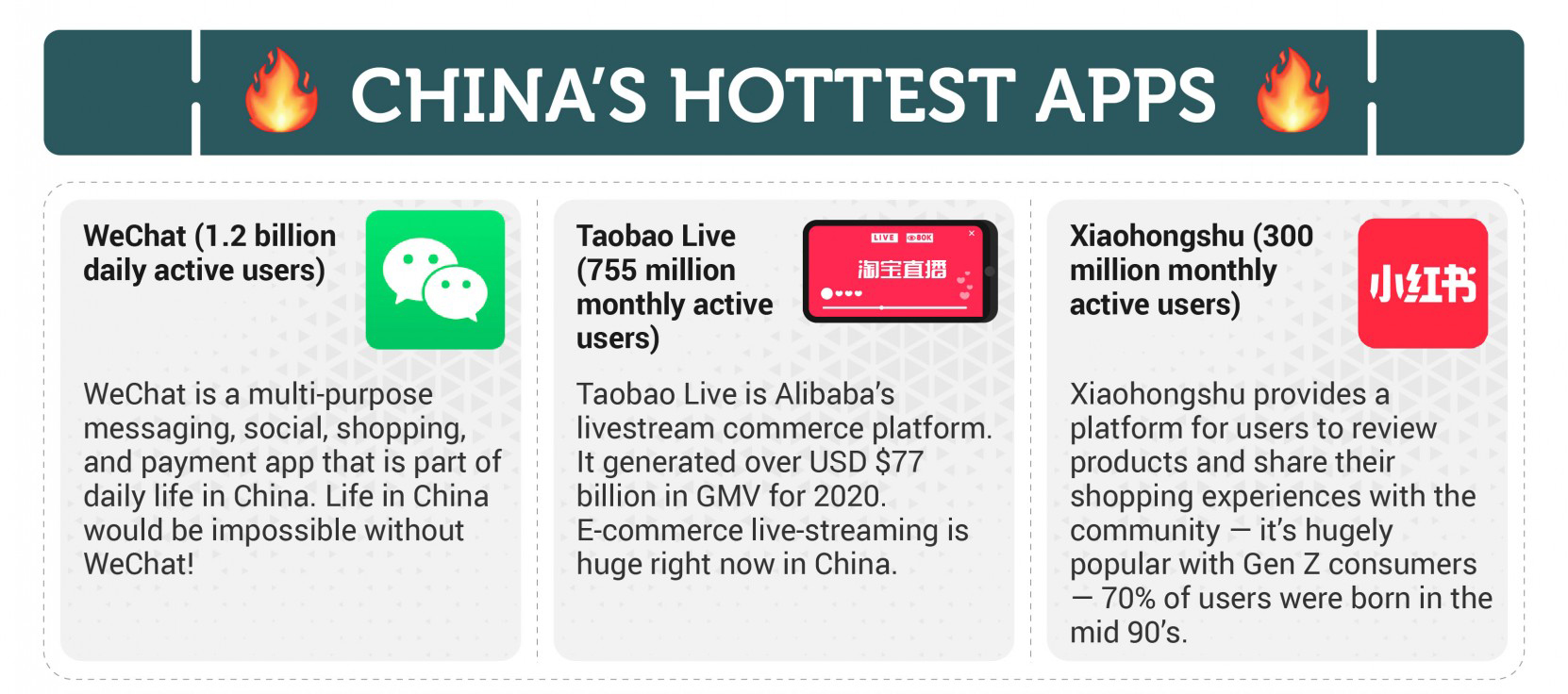

With 1.2 billion daily active users, WeChat is one of the world’s largest apps. It’s used for messaging, calling, photo and video sharing, shopping, banking, mobile payments, dating, and much, much more.

Douyin, China’s version of TikTok, has 650 million daily active users and saw e-commerce transactions triple to $77 billion USD in GMV, in 2020. And Pinduoduo, a social commerce app, saw its user base grow by a whopping 50% last year.

View our infographic: China’s hottest mobile apps 🔥

View our infographic: China’s hottest mobile apps 🔥

Brands in most categories will want to establish a presence on WeChat. As one of the world’s most active apps, it’s a key brand awareness channel – with a growing e-commerce offering.

To know which other Chinese social apps your brand should be prioritizing, you’ll need to understand where users in your category are spending their time online. For consumer brands in categories like cosmetics, that’s going to include channels like Little Red Book (Xiaohongshu), Douyin (China’s TikTok), Weibo, and Bilibili.

Chinese social media presents an enormous opportunity for brands looking to build customer loyalty and drive repeat purchases. That’s because China’s e-commerce platforms operate on a pay-to-play basis. Even if a customer has purchased from you before, you’ll need to spend on advertising to appear in their search results again.

Chinese social media, on the other hand, enables you to build highly engaged communities that belong to your brand.

That said, it’s also a highly competitive space. If you’re to steal consumers’ attention away from your competition, then you’ll need to get creative and stand out (we can help).

KOLs and micro-KOLs (influencers and micro-influencers) 🕺

Influencers are a driving force behind digital marketing in China.

Known locally as KOLs (Key Opinion Leaders), Chinese influencers have the ability to make products trend quickly and can drive purchases through the roof.

In a recent Chinese consumer survey conducted by Rakuten Insight, about 81% of respondents who had followed one or more influencers on social media said that they had purchased the products endorsed by them.

There’s almost no limit to the amount of money you can spend on KOLs. Some of China’s top influencers will charge thousands of dollars for a fragment of their time. But you’re ultimately paying for their following.

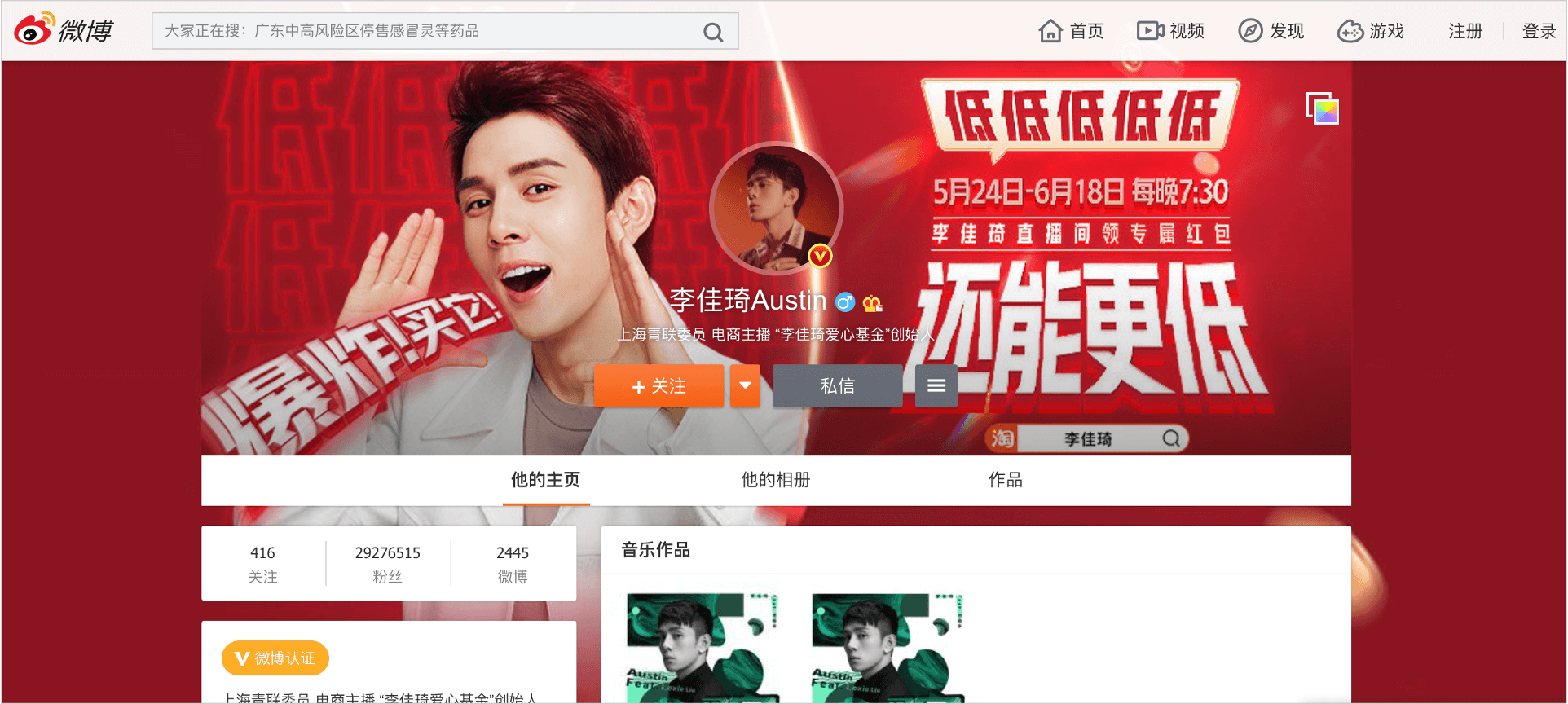

Austin Li has amassed a huge following on the Chinese micro-blogging platform, Weibo.

Austin Li — known as “The Lipstick King” for once selling 15,000 lipsticks on Taobao in five minutes — has over 45 million fans on Douyin. Viya, another top KOL, has amassed over 38 million followers on Taobao and has managed to draw in over 37 million viewers to a single livestream.

Most brands could only dream of such reach, and the association between your brand and a top KOL can keep consumers purchasing your product long after a campaign has ended.

Though there can also be drawbacks to using leading KOLs in China. For one, many top KOLs will require your product to be heavily discounted for livestreams — sometimes by as much as 75%. That can be harmful to margins and to driving repeat purchases.

You may also not be able to reuse any of the content that top KOLs push out through their own channels. Even though they’re promoting your product, if they’re doing so via their own social accounts, then you will often need authorization from them to use it.

Rather than splashing out on a top KOL for a single campaign, some brands use micro-influencers or even hired actors (who come at a fraction of the price).

A good China digital marketing agency will be able to advise on the best approach for your brand (get in touch).

Livestreaming in China 🤳

In 2019, China’s livestream e-commerce market was estimated to be worth $63 billion USD. And since the onset of COVID globally, it’s only accelerated. This year, it’s expected to be worth $305 billion USD and to account for 15% of China’s total e-commerce sales.

When it comes to digital marketing in China, livestreaming is the HOTTEST tactic right now. It’s a great way to both grow brand awareness and shift inventory.

Think of livestreaming as QVC meets the digital age. Livestream hosts demonstrate and critique products, discuss the features and answer consumer questions. There’s typically exciting music and coupons and product links will pop-up on users’ screens, with hosts urging viewers on with calls to action like “grab it now”.

Categories such as food and beverage, toys, sporting goods, fashion, mother/child/baby, homewares, consumer electronics, health, and cosmetics — tangible products that are popular with younger audiences — typically perform best on e-commerce livestreams.

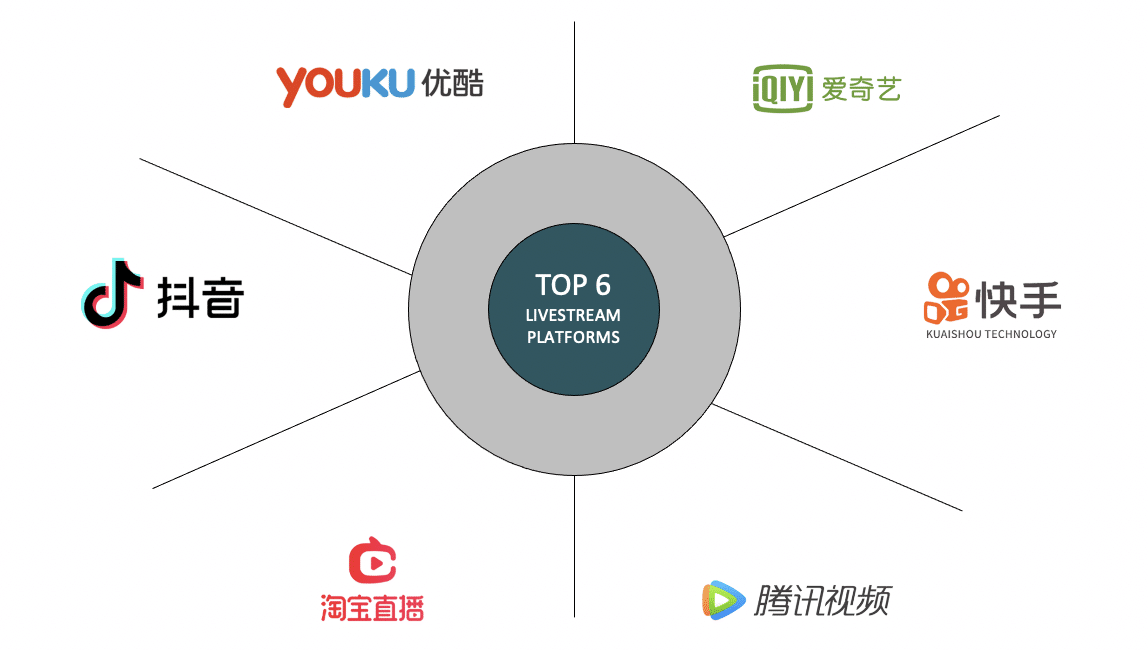

There are a number of places where consumers in China can watch livestreams, including:

- Youku – often referred to as the YouTube of China

- iQiyi – owned by Baidu, iQiyi is China’s equivalent of Netflix

- Kuaishou – partnered with JD.com (Kuaishou users can buy JD products without leaving the app)

- Tencent Video – China’s second-largest video-streaming platform after iQiyi

- Taobao Live – which serves as the livestream commerce channel for Alibaba’s China retail marketplaces

- Douyin – China’s version of TikTok

Where you run your livestream will often depend on whether you’re using influencers. You may want to lean on a top China KOL’s following to get your brand the greatest exposure in the market. Or you may find that a micro-KOL or a standard hired actor is best for your budget.

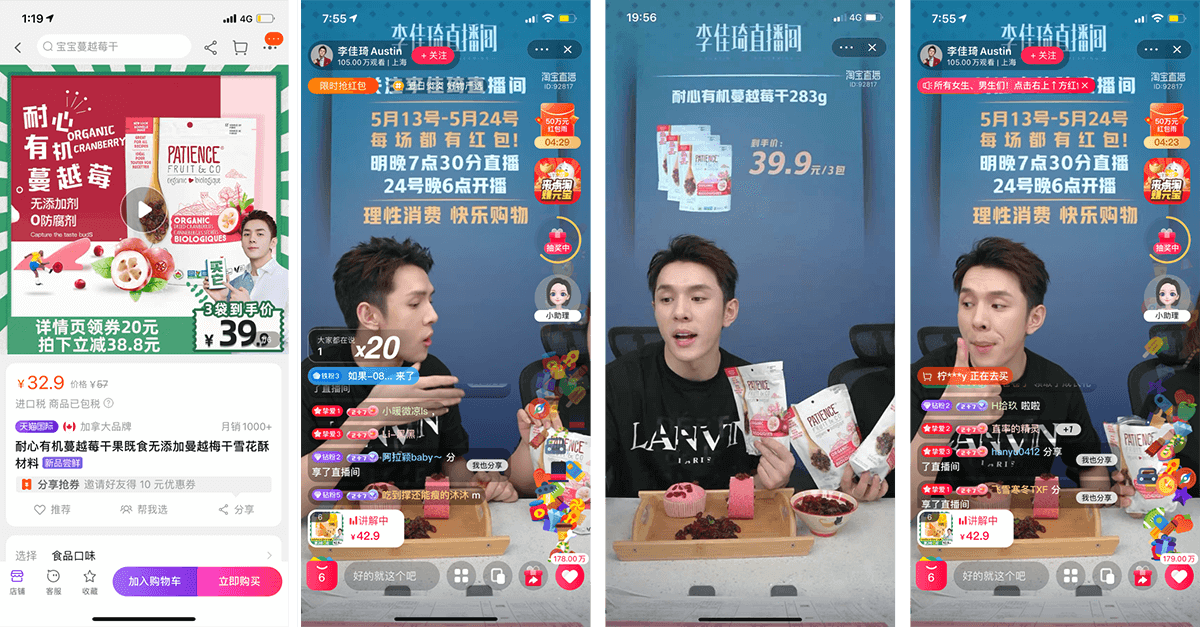

Austin Li “The Lipstick King” livestreaming for WPIC + Patience Fruit & Co (Fruit d’Or)

If you’re brand new to the China market, it’s sometimes best not to jump straight into livestreaming with a top KOL. It can be difficult to predict the demand it will drive — and the last thing you want is too many orders that your brand can’t fulfil (more on this later).

We recently ran a livestream for Patience Fruit & Co (Fruit d’Or) with China’s leading KOL, Austin Li. He sold 40,000 fruit products in less than 3 minutes.

Start small and work your way up.

Brand collaborations 🤝

Brand collaborations are a great way of getting more bang for your buck. They’re something you seldom see in the West, but they’re pretty popular in China.

A brand collaboration essentially means running a joint marketing campaign with a brand whose products complement your own – and then splitting the costs.

For example, we recently ran a joint livestream for a kitchenware company and a fruit company. We built a kitchen in one of our studios and took consumers through various recipes, whilst promoting the kitchenware and the food products.

🎥 We have x11 livestream studios across our Nanjing and Hangzhou e-commerce campuses, capable of capturing 200 hours of footage every single day.

Discounts and promotions 💲💲

6/18 (JD’s birthday) is a huge event in the Chinese calendar – discounts last around 20 days.

We typically advise against launching your product in China at a heavy discount.

A lot of brands fall for this as it’s a quick and easy way to generate sales, but it’s incredibly difficult to then push your price back up — consumers will just stop buying.

There are also lots of promotional days in China where you’ll be expected to offer heavy discounts, and you don’t want to be offering discounts on top of discounts.

Free delivery is a much better promotion to run in your China digital marketing campaigns. If you have product in a warehouse in Nanjing, for instance, then an item under 2-3 kg is going to cost you around 50-75 cents to ship to the million-plus people in that catchment area — and that’s for same-day delivery.

Even for heavy items from the North of China to the South, you’re still looking at no more than 1-2 dollars. So free delivery is a really cheap way of adding value.

Read about Chinese consumers’ expectations around shipping and deliveries.

WPIC has 65,000 sq ft of warehousing in Nanjing – view 3PL solutions

Only market what you can fulfill ⚠️

Wherever you end up focusing your budget for digital marketing in China, just be sure you’re able to fulfill the demand that arises.

Everything in China happens x10. If you’re using a top influencer and your livestream ends up generating huge demand for your product, are you going to be able to fulfill all those orders? Because if you’re not, then you’re in dangerous territory.

Reputation in China is everything. To consumers and the platforms. That livestream could see you upsetting hundreds and thousands of consumers in the market — or even getting kicked off Tmall and JD. It can be difficult to recover from that.

When you’re activating digital marketing in China, it’s best to test your ability to meet demand. Do a reload of inventory once, twice, three times. Prove you can sell, liquidate, fulfill, and deal with customer enquiries.

Positive ratings on Vasanti’s Tmall Global store

Get positive reviews on your e-commerce store, build up your customer service capabilities, and then once you have an air-tight system in place, your China marketing campaigns can be scaled. Then you can confidently start building velocity with sales and really move the revenue needle.

Looking to activate digital marketing in China?

WPIC is the #1 China digital marketing agency. We’ve helped 650+ brands grow revenue in Asia throughout our 17 years in business. We’re also a 5-star Tmall partner and can activate your brand on China’s leading e-commerce platforms. If you need support with your China market entry or if you’re in the market but are struggling to generate sales, we can help.

View digital marketing solutions or submit a form below to get in touch 👇